What to Know About Unemployment Fraud

The Department of Employment and Workforce (DEW) needs your help preventing UI fraud and abuse. Your participation strengthens DEW’s efforts to ensure South Carolina employers' tax dollars are spent wisely and UI benefits only go to eligible individuals.

DEW offers several options to report suspected cases of unemployment benefit fraud, identity theft and job refusals. The preferred method to submit your report of suspected UI fraud and abuse is through our online form.

All tips received are investigated regardless of how much information is provided. However, the more details you can provide, the more you can help DEW in the investigation.

Claimant Fraud

Claimant can be a victim of a criminal or fraudster. This could occur when:

- An individual receives a payment or check for which they did not apply.

- Someone responds to a phishing email or text with their personally identifying or claimant information or enters their username and password on a fraudulent website.

- A fraudster changes information in a claim to receive someone else's benefits - also known as hijacking a claim.

- Someone receives a 1099-G but were never unemployed or did not apply for or receive UI benefits.

Claimants can prevent fraud by following these guidelines:

- Accurately reporting the reason you are unemployed.

Accurately report your reason for separation from your job when you initially file your claim for benefits. After a claim is filed, the separating/most recent employer is sent a Notice of Claim Filing and Request for Separation Information.

- Report any wages you have earned

You must report your gross wages (earnings before taxes and other deductions) for each week you work and claim unemployment benefits, even if you have not actually been paid for the work. This includes part-time or temporary work. DEW utilizes a quarterly wage cross-match system. The cross-match compares benefits paid to wages reported by employers under the same social security number during the same quarter. - Report when you are not able or available to seek or accept work

You must be physically able and available to perform some type of work (even if it is not your regular field of work). Notify DEW if you are not ready, willing and able to work (e.g., out of the area, on vacation, sick, suffering total disability) while collecting UI benefits. This is self-reported during your weekly certification.

- Report all job refusals

If you refuse an offer of work, you must report your refusal to DEW, who will determine if there was good cause to refuse the work. The employer is also required to report refusals for work to DEW, which can jeopardize your benefits if you don’t self-report.

- Avoid errors and ensure proper payment of benefits

To prevent errors that may result in an overpayment, read all of the information in the Claimant Handbook.

- Stop claiming unemployment benefits as soon as you begin working

As soon as you begin working, simply stop filing a weekly claim. Do not wait until you receive your first paycheck.

- Actively search for work

Claimants are required to conduct an active search for work for each week you claim UI benefits, unless you are notified you are exempt. You are required to make a minimum of two new verifiable job searches within SC Works Online Services (SCWOS). - Know your responsibilities and ask for help

Navigating through the UI system can be confusing. Do not risk losing your benefits because you do not know your rights and responsibilities. If you have a question, UI customer service representatives are here to help. Call UI Customer Service at 866-831-1724 | Relay 711. Customer Service hours are available Monday through Friday, excluding some national holidays.

Please note and be advised of the following tips to avoid fraud and scams while working with our agency:

- DEW will never charge you for services.

- Paying someone will not process your claim faster.

- Do not post your personal or claimant data to any social media platform.

- Our agency will not leave claim information on a voicemail. If we leave you a message, we will ask you to return our call to speak with you personally.

- Complete all information on a claim honestly, including any wages earned each week that you certify.

- Do not give anyone your username and password to the MyBenefits portal.

- Do not send personal or claimant information through social media comments. The agency's Facebook and Instagram accounts are verified. Any other accounts claiming to help you with your personal claim or get your benefits are a scam.

- Do not click links or provide personally identifying information through text or email. DEW will not send text messages or emails soliciting information.

- Ensure you are on the official DEW and MyBenefits sites before inputting your username or password. Look for the lock icon and dew.sc.gov or scuihub.dew.sc.gov in the address bar.

Click here to return to the top of the page.

Employer Fraud

Employers can prevent fraud and help strengthen the integrity of the UI program by taking the following actions:

- Proper Classification of Workers

For the purpose of unemployment insurance, an employer must classify its workers as either employees or independent contractors. Employers are required to pay unemployment tax on employees' earnings but not on independent contractors. In the event a worker is misclassified as an independent contractor, taxes will not have been paid and the worker's wages will not have been reported. A wage and liability investigation of the employer would be initiated by DEW to determine proper classification. If misclassification is determined, the employer may be liable for payment of all back taxes, with interest and penalties.

- Review Quarterly Statements of Benefit Charges

At the end of each quarter, most employers receive a copy of all UI benefits charged against their account for that quarter. Please review all benefit charges carefully. Benefit charges will affect your unemployment tax rate at a later date. If you disagree with any of the benefit charges or find any errors, you must protest the charges within 30 days of the date the notice is mailed.

- Report all new hires to the South Carolina New Hire Reporting Program (verify accuracy)

The New Hire Reporting Program is a database administered by the S.C. Department of Social Services (DSS) and used by DEW to identify individuals who are working and collecting UI benefits. Reporting new hires helps keep UI tax costs down by ensuring that only individuals who are eligible receive UI benefits. Become an active participant in preventing overpayment of UI benefits by reporting all of your newly hired and rehired employees on the S.C. New Hire website. - Respond to Notice of Claim Filing and Request for Separation Information

When a former employee files for UI benefits, you have the opportunity to supply information to DEW regarding the reason the individual is now unemployed. You must respond to the department within 10 calendar days of receiving the notification in order to prevent a former employee from wrongfully receiving UI benefits. For more information on how to respond to a separation request visit this page. - Respond to Wage Audit Notices

Each week DEW cross-checks wage and new hire databases with the unemployment benefit recipient database in order to identify individuals who may have improperly received unemployment benefits while being employed. Claims with potential for conflict are audited via Wage Audit Notices that are sent to the current employer of the individual in question. Wage Audit Notices should be completed and returned within 10 calendar days. Watch video about Wage Audit Notices. - Provide accurate wage information

Providing DEW with accurate wage information for your workers ensures that individuals are paid the correct amount of UI benefits. - Refrain from engaging in tax manipulation schemes.

Under the experience rating system, employers pay unemployment taxes at rates proportionate with claims activities by their employees. Employers with high unemployment activity pay higher unemployment tax rates, and employers with lower activity pay less. Employers who engage in SUTA Dumping or other tax manipulation schemes to avoid paying their fair share unfairly shift their costs to other employers.

WHAT YOU CAN DO TO PROTECT YOUR EMPLOYEES FROM UI BENEFIT FRAUD AND LESSEN THE IMPACT ON YOUR TAX RATE.

REVIEW Your Employer Notices

Verify Social Security Numbers at the time of hire, to ensure that your employees’ names and Social Security Numbers (SSN’s) match the Social Security Administration’s records. Visit the SSA at www.ssa.gov/employer to verify names and SSN’s online.

UI benefits paid to your current employees represent a charge to your account and may impact your tax rate. To protect your account, carefully review all notices received in your Employer Self-Service account or by mail. When an employee files a claim for unemployment, employers will receive a Request to Employer for Separation Information, by mail and online via their Employer Self-Service account. The monetary determination will contain information about the employee and the reason for separation and more. If you notice inaccurate information, or if the employee referenced is still working for you, it is very important that you notify us.

WHAT TO DO IF AN EMPLOYER SUSPECTS FRAUD OR IDENTITY THEFT

Immediately protest the Monetary Determination and/or Request for Separation Information notifying DEW within 10 days of the mail date on the notices. This will help prevent the claim from entering pay status.

To send a protest through Employer Self-Service Dashboard, please review instructions on DEW's Employer Separation Response webpage.

To submit a written protest, please mail or fax as instructed on the letter.

Have the victim report the fraudulent activity immediately as well.

You can also report fraud by calling 1-800-868-1488 | Relay 711.

Click here to return to the top of the page.

Identity Theft & Imposter Claims

If you think someone has filed a UI claim in your name (i.e. you received a 1099 form that indicates you received UI benefits, but you never filed for UI), report the identity theft fraud to all of the following entities:

1. DEW by clicking here

2. Your employer

3. File the attached form with the IRS

4. File a police report with your local police department. Obtain a copy of the report that you can provide to creditors and credit agencies.

5. File a complaint with the National Center for Disaster Fraud.

6. Report identity theft to the Federal Trade Commission (FTC).

Additional actions to consider:

7. Change passwords on your MyBenefits portal, email, banking, and other personal accounts.

8. Make a list of credit card companies, banks, and other financial institutions where you do business. Tell them you are a victim of identity theft, and ask them to put a fraud alert on your account.

9. Get a copy of your credit report and dispute any fraudulent transactions. You can request credit reports online from the 3 major credit reporting agencies:

- Equifax: 800-349-9960 or https://www.equifax.com/personal/

- Experian: 888-397-3742 or https://www.experian.com/

- TransUnion: 888-909-8872 or https://www.transunion.com/

10. Place a credit freeze with each of the 3 major credit reporting agencies by calling the agencies or freezing your credit online.

11. Place a fraud alert on your credit file. You can do this by contacting just one of the credit agencies to add an alert with all three agencies.

12. If you suspect that someone is using your SSN for work purposes, contact the Social Security Administration at 800-772-1213 to report the problem. They will review your earnings with you to ensure they are correct. You can also review earnings posted to your social security statement www.socialsecurity.gov/mystatement for workers 18 and older.

13. After reporting theft to DEW, complete the following form: Statement of Non-Receipt of Unemployment (UI) Benefits and email to fraud_reporting@dew.sc.gov.

NOW THAT I HAVE REPORTED ID THEFT, WHAT'S NEXT?

For more information about 1099-G’s and taxes owed to the IRS each year for benefits received, visit this webpage.

Visit the IRS' website on Employment-Related Identity Theft if you think you've been a victim of identity theft

WHAT IS IDENTITY THEFT AND HOW DO I PREVENT IT?

Individual: Identity Theft

Identity theft occurs when someone uses another person's information—including wage, employment, and credit card information—to take on their identity. Identity thieves can also use another person’s name, Social Security number, and employment information to illegally file UI claims and collect UI benefit payments.

If you suspect that identity thieves have used your personal information, or the personal information of one of your employees to file a false UI claim, it is essential that you act fast to help DEW stop an imposter claim.

Employer: Protecting your business and employees from ID theft

Identity theft is on the rise in both the private and public sector. The growing problem of committing unemployment fraud using stolen IDs not only affects the victims - those who have had their personal information compromised - but it also can have a negative effect on an employer’s tax rate.

Identity theft occurs when someone uses another person’s information to take on his or her identity. Identity theft can include wage and employment information as well as credit card and mail fraud. In the case of unemployment benefits, it could mean using another person’s information such as name, Social Security Number and employment information.

As employers, you can help save millions of dollars in fraudulent payments by identifying suspected fraud. In many cases, you may be the first to have information that unemployment fraud is occurring.

Click here to return to the top of the page.

Report Fraud

You have two ways to report fraud. You can complete the online fraud form using the button above or you can call the fraud hotline at 1-800-868-1488. When reporting, provide as many details as possible regarding the fraud you’re reporting including:

- The name, address, Social Security number (if available), or individual or business suspected of committing fraud.

- The business’s name and address involved with the allegation.

- Specific dates surrounding the allegation, hours or times worked, and specific details that help substantiate the allegation.

To report identity theft fraud, please click on the Identity Theft and Imposter Claims tab and click the button titled "Click Here To Report Identity Theft Fraud".

Note:

You do not have to provide your name or identifying information to file a fraud allegation unless you want to. Any contact information provided remains confidential.

Penalties of UI Fraud

Claimants:

DEW partners with the SC Attorney General to fine and prosecute UI fraud. If you are found guilty of UI fraud, you will be disqualified from receiving benefits for up to 52 weeks. Providing false information is a crime and subjects you to legal action with fines up to $100,000 and imprisonment up to 10 years.

You also will have to pay back any overpayments received as a result of incorrectly reporting wages. This might mean DEW intercepting your state and federal income taxes and the withholding of future wages to settle the debt.

Read more about overpayments and DEW’s income tax interception programs on the DEW overpayments webpage and selecting the "Failing to Repay an Overpayment" tab.

Employers:

- Employers must pay the total amount of taxes owed, interest, and late-payment penalties.

- DES may work with your local district attorney’s office to prosecute you. You could be charged with a Class 1 misdemeanor and face a fine and up to 120 days in jail for each count.

- You may have to pay a penalty of 50% of the tax amount owed.

- You will pay a monthly penalty of 5% of the taxes owed for not filing by the original due date, up to 25% of the total owed.

Click here to return to the top of the page.

Fraud FAQ

- What is Unemployment Insurance fraud?

Unemployment insurance (UI) fraud can occur when a claimant, employer or any other person knowingly makes a false statement or misrepresentation or knowingly fails to disclose a material fact. "False statement or misrepresentation" means a statement or representation made by a person that is false, material, made with the person's knowledge of the falsity of the statement and made with the intent of obtaining or causing another to obtain or attempting to obtain or causing another to obtain an undeserved economic advantage or benefit or made with the intent to deny or cause another to deny any benefit or payment in connection with a UI claim or UI tax payment.

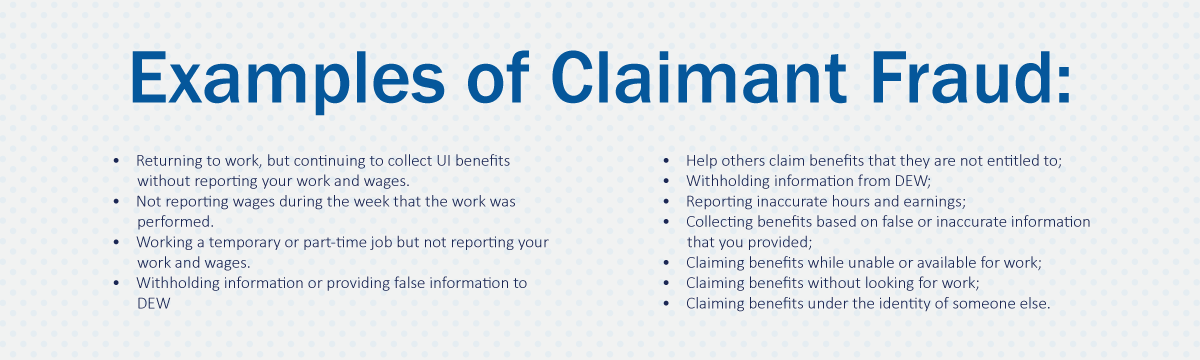

- What are examples of claimant fraud?

- Returning to work, but continuing to collect UI benefits without reporting your work and wages.

- Not reporting wages during the week that the work was performed.

- Working a temporary or part-time job but not reporting your work and wages.

- Withholding information or providing false information to DEW

- Help others claim benefits that they are not entitled to;

- Withholding information from DEW;

- Reporting inaccurate hours and earnings;

- Collecting benefits based on false or inaccurate information that you provided;

- Claiming benefits while unable or available for work;

- Claiming benefits without looking for work;

- Claiming benefits under the identity of someone else.

- How can claimants avoid committing fraud?

Accurately reporting the reason you are unemployed.

- Accurately report your reason for separation from your job when you initially file your claim for benefits. After a claim is filed, the separating/most recent employer is sent a Notice of Claim Filing and Request for Separation Information.

Report any wages you have earned

- You must report your gross wages (earnings before taxes and other deductions) for each week you work and claim UI benefits, even if you have not actually been paid for the work. This includes part-time or temporary work. DEW utilizes a quarterly wage cross-match system. The cross-match compares benefits paid to wages reported by employers under the same social security number during the same quarter.

Report when you are not able or available to seek or accept work

- You must be physically able and available to perform some type of work (even if it is not your regular field of work). Notify DEW if you are not ready, willing and able to work (e.g., out of the area, on vacation, sick, suffering total disability) while collecting UI benefits. This is self-reported during your weekly certification.

Report all job refusals

- If you refuse an offer of work, you must report your refusal to DEW, who will determine if there was good cause to refuse the work. The employer is also required to report refusals for work to DEW, which can jeopardize your benefits if you don’t self-report.

Avoid errors and ensure proper payment of benefits

- To prevent errors that may result in an overpayment, read all of the information in the Claimant Handbook.

Stop claiming UI benefits as soon as you begin working

- As soon as you begin working, simply stop filing a weekly claim. Do not wait until you receive your first paycheck.

Actively search for work

- (Requirement is currently suspended) – Claimants are required to conduct an active search for work for each week you claim UI benefits, unless you are notified you are exempt. You are required to make a minimum of two new verifiable job searches within SC Works Online Services (SCWOS).

Know your responsibilities and ask for help

- Navigating through the UI system can be confusing. Do not risk losing your benefits because you do not know your rights and responsibilities. If you have a question, UI customer service representatives are here to help. Call UI Customer Service at 866-831-1724 | Relay 711. Customer Service hours are available Monday through Friday, excluding some national holidays.

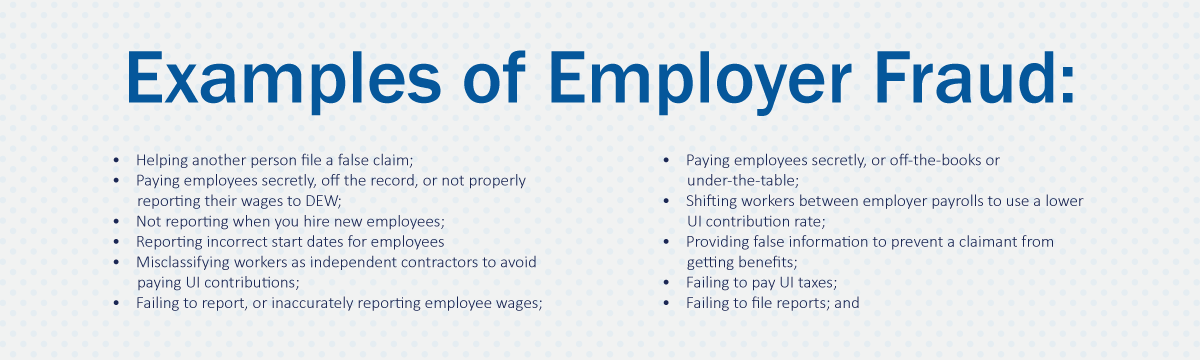

- What are examples of employer fraud?

- Helping another person file a false claim;

- Paying employees secretly, off the record, or not properly reporting their wages to DEW;

- Not reporting when you hire new employees;

- Reporting incorrect start dates for employees Misclassifying workers as independent contractors to avoid paying UI contributions;

- Failing to report, or inaccurately reporting employee wages;

- Paying employees secretly, or off-the-books or under-the-table;

- Shifting workers between employer payrolls to use a lower UI contribution rate;

- Providing false information to prevent a claimant from getting benefits;

- Failing to pay UI taxes;

- Failing to file reports.

- How can employers avoid committing fraud?

Proper Classification of Workers

- For the purpose of UI, an employer must classify its workers as either employees or independent contractors. Employers are required to pay UI tax on employees' earnings but not on independent contractors. In the event a worker is misclassified as an independent contractor, taxes will not have been paid and the worker's wages will not have been reported. A wage and liability investigation of the employer would be initiated by DEW to determine proper classification. If misclassification is determined, the employer may be liable for payment of all back taxes, with interest and penalties.

Review Quarterly Statements of Benefit Charges

- At the end of each quarter, most employers receive a copy of all UI benefits charged against their account for that quarter. Please review all benefit charges carefully. Benefit charges will affect your UI tax rate at a later date. If you disagree with any of the benefit charges or find any errors, you must protest the charges within 30 days of the date the notice is mailed. You may submit your protest online using the Employer Charge Protest portal.

Report all new hires to the South Carolina New Hire Reporting Program (verify accuracy)

- The New Hire Reporting Program is a database administered by the S.C. Department of Social Services (DSS) and used by DEW to identify individuals who are working and collecting UI benefits. Reporting new hires helps keep UI tax costs down by ensuring that only individuals who are eligible receive UI benefits. Become an active participant in preventing overpayment of UI benefits by reporting all of your newly hired and rehired employees on the S.C. New Hire website.

Respond to Notice of Claim Filing and Request for Separation Information

- When a former employee files for UI benefits, you have the opportunity to supply information to DEW regarding the reason the individual is now unemployed. You must respond to the department within 10 calendar days of receiving the notification in order to prevent a former employee from wrongfully receiving UI benefits. For more information on how to respond to a separation request visit the UI Benefits page.

Respond to Wage Audit Notices

- Each week DEW cross-checks wage and new hire databases with the UI benefit recipient database in order to identify individuals who may have improperly received UI benefits while being employed. Claims with potential for conflict are audited via Wage Audit Notices that are sent to the current employer of the individual in question. Wage Audit Notices should be completed and returned within 10 calendar days. Read more about Wage Audit Notices here.

Provide accurate wage information

- Providing DEW with accurate wage information for your workers ensures that individuals are paid the correct amount of UI benefits.

Refrain from engaging in tax manipulation schemes.

- Under the experience rating system, employers pay UI taxes at rates proportionate with claims activities by their employees. Employers with high UI activity pay higher UI tax rates, and employers with lower activity pay less. Employers who engage in SUTA Dumping or other tax manipulation schemes to avoid paying their fair share unfairly shift their costs to other employers.

- How do I report UI fraud? (online, call and mail options.)

ONLINE: You can complete the online fraud form here

CALL: Call the fraud hotline at 1-800-868-1488 | Relay 711,

MAIL: DEW Fraud Investigations PO Box 995 Columbia, SC 29202When reporting, provide as many details as possible regarding the fraud you’re reporting including:

- The name, address, Social Security number (if available), or individual or business suspected of committing fraud.

- The business’s name and address involved with the allegation.

- Specific dates surrounding the allegation, hours or times worked, and specific details that help substantiate the allegation.

Note: You do not have to provide your name or identifying information to file a fraud allegation unless you want to. Any contact information provided remains confidential.

- What are the consequences of committing UI Fraud?

When a claimant intentionally conceals information affecting UI eligibility, they will be disqualified from future benefits anywhere from 10 to 52 weeks depending on the severity of the false statements. The claimant is also assessed a 33 % monetary penalty based on the amount of benefits overpaid due to fraud.

- How does DEW find out about UI fraud?

The department has various means to detect fraud and abuse. A few include: auditing employer records, comparing benefit claims to payroll records in South Carolina and other states, exchange of information between agencies, complaints from employers and tips from the public.

- What can happen if you commit UI fraud?

Any benefits paid as a result of fraud must be paid back. Also, South Carolina law provides for penalties and/or criminal prosecution for fraudulent claims.

- When is someone prosecuted for UI fraud?

DEW partners with the SC Attorney General to fine and prosecute UI fraud. If you are found guilty of UI fraud, you will be disqualified from receiving benefits for up to 52 weeks. Providing false information is a crime and subjects you to legal action with fines up to $100,000 and imprisonment up to 10 years.

You also will have to pay back any overpayment received because of incorrectly reporting wages. This might mean DEWs intercepting your state and federal income tax refunds and the withholding of future wages to settle the debt.- What is employer aiding and abetting?

An employer aids and abets a fraudulent claim if the employer assists or conspires with a person to make a false statement or misrepresentation.

- What happens to employers for aiding and abetting?

An employer aids and abets a fraudulent claim if the employer assists or conspires with a person to make a false statement or misrepresentation.

- What is Identity Theft/Imposter Fraud?

Identity theft is a crime in which an imposter obtains key pieces of personally identifiable information (PII), such as Social Security or driver's license numbers. In the context of UI, ID theft is often categorized as imposter fraud where criminals use another person’s stolen PII to file a fraudulent UI claim.

- How do I know if I’m a victim of imposter fraud?

Many people find out when they receive an unexpected letter from DEW. Many also find out when DEW notifies an employer that a current employee has applied for UI benefits. The employer then notifies the employee.

- What should I do if I suspect I’m a victim of an imposter fraud?

If you think someone has filed a UI claim in your name (i.e. you received a 1099 form that indicates you received UI benefits, but you never filed for UI), report the fraud online by clicking the “Report Fraud” tab. You can also call the DEW Fraud Hotline at 1-800-868-1488 | Relay 711.

For more information about 1099-G’s and taxes owed to the IRS each year for benefits received, visit this webpage. You may also visit the IRS' website on Employment-Related Identity Theft if you think you've been a victim of identity theft.

If you suspect your PII has been misused, the South Carolina Department of Consumer Affairs has created the ID Theft Central website to assist you in reporting possible ID theft. The website address is https://consumer.sc.gov/identity-theft-unit/id-theft. Once you have accessed the website, click on the "Report Identity Theft” Banner and follow the instructions. This website also contains additional instructions and resources to help you prevent further identity theft.

- What will happen after I have reported identity theft/imposter fraud?

A hold will be placed to prevent additional payments from being made and you may be contacted for additional information. Federal and State law prohibits SCDEW from disclosing any additional information about the individual that may be using your identity. Law enforcement can request and receive information from SCDEW that is necessary to pursue an investigation if you choose to file a police report

- What should employers do for their employees who experience imposter fraud?

Employers should:

- Immediately notify their employees about the fraudulent claim.

- Either instruct employees to report the fraud, or report fraud on behalf of their employees, using the methods on the Report UI Fraud page.

- Instruct employees to follow directions under If You're a Victim of Identity Theft.

- If Someone Steals My Identity and DEW Pays Benefits Under My Name To The Fraudster, Am I Responsible For Paying Back The Money?

No. If the investigation finds that you were a victim of imposter fraud, you will not need to pay back the money.

- If someone steals my identity and uses my information to apply for UI benefits, can I still apply for benefits?

Yes. We’ll be able to distinguish your legitimate claim from a fraudulent one.